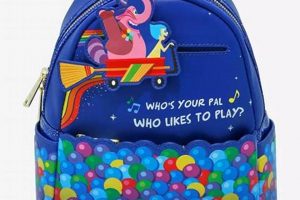

A themed carrying accessory, often characterized by vibrant colors and playful depictions of the classic Walt Disney character, Goofy, and manufactured by the brand Loungefly, is a popular item. These backpacks blend functionality with a distinct, often cartoonish, aesthetic. For example, a user might select one featuring Goofy in a Hawaiian shirt for a theme park visit.

These items offer a way to express personal style and fandom. The appeal extends beyond practicality, functioning as collectible merchandise. Historically, Loungefly has cultivated a niche by producing licensed accessories, connecting popular culture figures with everyday items. This specific type of backpack resonates with consumers seeking a tangible connection to beloved characters and brands.

The remainder of this discussion will delve into the design elements, the target demographic, and the collectability aspects of character-themed accessories, with a particular emphasis on how the perceived value contributes to consumer demand and the overall market trends.

Considerations for Acquiring Themed Accessories

The following outlines key considerations for individuals contemplating the purchase of character-themed backpacks, focusing on factors influencing value and suitability.

Tip 1: Authenticity Verification: Prior to purchase, rigorously verify the accessory’s authenticity. Counterfeit products often lack the quality materials and construction inherent in officially licensed merchandise, potentially impacting longevity and resale value.

Tip 2: Design Scarcity Assessment: Evaluate the design’s rarity. Limited-edition or exclusive designs typically command higher prices on the secondary market. Research production numbers and availability through official channels or collector communities.

Tip 3: Material Durability Inspection: Examine the materials used in construction. Opt for accessories constructed from durable materials, such as high-quality faux leather or reinforced stitching, to withstand regular use and preserve the design.

Tip 4: Hardware Functionality Evaluation: Assess the functionality of zippers, straps, and buckles. Ensure these components are robust and function smoothly to prevent premature wear or damage.

Tip 5: Internal Storage Capacity Analysis: Consider the internal storage capacity and organizational features. Evaluate whether the backpack meets the intended user’s needs for carrying essential items while maintaining the accessory’s structural integrity.

Tip 6: Collectible Potential Research: Investigate the potential for future appreciation in value. Monitor collector forums and auction sites to gauge demand for similar designs and brands.

Tip 7: Proper Storage Techniques: Implement appropriate storage techniques to minimize environmental damage. Store the accessory in a dust bag or protective case when not in use, and avoid exposure to direct sunlight or extreme temperatures.

By considering these factors, consumers can make informed decisions regarding the acquisition and preservation of character-themed accessories, optimizing their investment and long-term enjoyment.

The subsequent section will examine consumer demographics and marketing strategies related to these specific products.

1. Brand Recognition

Brand recognition functions as a critical component in the market success of accessories such as a character-themed backpack. Loungefly, as a brand, has cultivated a strong association with licensed merchandise and distinctive design aesthetics. This pre-existing familiarity and positive brand image directly influence consumer purchasing decisions. For example, a consumer, already familiar with Loungefly’s reputation for quality, is more likely to choose a specific character-themed backpack, trusting the brand’s adherence to certain standards.

The connection between brand recognition and these accessories extends beyond mere awareness. It fosters a sense of trust and confidence. Consumers understand that the brand has obtained the proper licensing agreements and that the character depictions will meet certain quality standards. The brands reputation for producing durable and visually appealing products mitigates the perceived risk associated with purchasing novelty items. Moreover, a strong brand recognition allows Loungefly to command a premium price point compared to generic or unlicensed alternatives. This is due to the perceived value and authenticity that the brand association provides.

In summary, brand recognition operates as a pivotal factor influencing consumer behavior in the character-themed accessory market. A reputable brand, such as Loungefly, generates trust, fosters positive associations, and ultimately drives sales. The absence of this brand association would likely diminish consumer confidence and market value. Understanding this relationship allows for more effective marketing and product positioning strategies within this niche market.

2. Character depiction

Character depiction is a central element in the appeal and marketability of character-themed backpacks. The accuracy, style, and overall execution of the character’s image significantly impact consumer perception and purchasing decisions. In the context of a “goofy loungefly backpack,” the depiction of Goofy becomes a critical design consideration.

- Art Style Consistency

Maintaining consistency with the established art style of the character is crucial. A “goofy loungefly backpack” must faithfully represent Goofy as he appears in established Disney media. Deviations from this standard may alienate consumers seeking authentic merchandise. For example, inconsistencies in proportions, color palettes, or facial expressions can detract from the product’s appeal.

- Pose and Expression Selection

The chosen pose and expression of Goofy play a significant role in conveying the desired tone and personality of the backpack. A dynamic pose might suggest activity and adventure, while a more relaxed expression could convey whimsy and playfulness. The selection must align with the overall design aesthetic and target audience. For instance, a pose depicting Goofy in mid-stumble would reinforce his characteristic clumsiness.

- Contextual Integration

Integrating the character depiction seamlessly into the backpack’s design is paramount. The placement, scale, and integration of Goofy’s image should complement the overall form and function of the accessory. A poorly integrated character might appear as an afterthought, diminishing the product’s visual appeal. For example, Goofy’s image might be cleverly incorporated into a pocket design or the backpack’s flap.

- Licensing Adherence

Adherence to licensing agreements is non-negotiable. All character depictions must comply with the intellectual property rights held by Disney. Unauthorized use or misrepresentation of the character can result in legal repercussions and damage the brand’s reputation. Any “goofy loungefly backpack” must demonstrably be an officially licensed product to ensure authenticity and legal compliance.

These considerations highlight the importance of character depiction in determining the success of a “goofy loungefly backpack.” Accurate representation, thoughtful integration, and adherence to licensing protocols contribute to a product that resonates with consumers and aligns with brand expectations. Other examples may be seen in different depictions which influence whether or not a purchase is made.

3. Material quality

Material quality represents a fundamental determinant of the longevity, aesthetic appeal, and overall value of a character-themed backpack. The choice of materials directly influences the product’s ability to withstand daily use, maintain its visual integrity, and meet consumer expectations regarding durability and finish.

- Fabric Composition and Durability

The selection of fabric significantly impacts the backpack’s resistance to wear and tear. High-denier polyester or nylon fabrics offer enhanced abrasion resistance, preventing premature fraying or tearing. For example, a backpack constructed from a 600D polyester will typically exhibit greater durability than one using a lower-denier material. Reinforcement stitching at stress points further enhances the product’s ability to withstand heavy loads and rigorous use.

- Hardware Corrosion Resistance

Zippers, buckles, and other metal hardware components are susceptible to corrosion, particularly in humid environments. The use of corrosion-resistant materials, such as stainless steel or coated alloys, is essential to prevent degradation and maintain functionality over time. For instance, a backpack featuring zippers with a protective coating will exhibit greater resistance to oxidation and maintain smooth operation. Furthermore, proper maintenance, such as periodic cleaning and lubrication, can extend the lifespan of these components.

- Print and Embellishment Longevity

The quality of printing and embellishments directly affects the backpack’s aesthetic appeal and perceived value. Durable printing techniques, such as dye sublimation or screen printing with high-quality inks, ensure that the character depiction remains vibrant and resistant to fading or cracking. Similarly, securely attached embellishments, such as patches or appliques, prevent detachment and maintain the backpack’s visual integrity. The application of a protective coating can further enhance the durability of printed designs and embellishments.

- Lining Material Integrity

The lining material plays a crucial role in protecting the backpack’s contents and maintaining its structural integrity. A durable and tear-resistant lining fabric prevents items from snagging or damaging the interior. Additionally, a water-resistant lining can protect the contents from moisture in case of spills or inclement weather. For example, a backpack with a nylon lining will offer greater protection than one with a flimsy or easily torn material.

These material characteristics collectively determine the overall quality and long-term value of the “goofy loungefly backpack.” A careful consideration of these factors ensures that the product meets consumer expectations regarding durability, aesthetic appeal, and functionality. The integration of high-quality materials represents a key investment in the product’s longevity and contributes significantly to consumer satisfaction.

4. Target audience

The target audience for a character-themed backpack, such as a “goofy loungefly backpack,” significantly influences its design, marketing, and overall market success. The demographic profile, interests, and purchasing habits of the intended consumer base dictate the specific features and characteristics of the product. Understanding the target audience is paramount for effective product positioning and maximizing sales potential.

The demographic for character-themed backpacks commonly encompasses a broad age range, from children to young adults and adult collectors. Children often gravitate toward vibrant colors and simplified character depictions, prioritizing functionality and ease of use. Young adults, particularly those with a nostalgia for childhood characters, seek out designs that blend functionality with a subtle expression of fandom. Adult collectors, on the other hand, tend to prioritize authenticity, rarity, and adherence to established character aesthetics. This variation in consumer preferences necessitates a tiered approach to product development and marketing, catering to the specific needs and desires of each segment. A “goofy loungefly backpack” targeted at younger children might feature simplified graphics and easily adjustable straps, while a version aimed at collectors would emphasize detailed character renderings and limited-edition status.

Therefore, a comprehensive understanding of the target audience provides essential guidance for all aspects of the product lifecycle, from design and manufacturing to marketing and distribution. A well-defined target audience ensures that the product aligns with consumer needs, maximizes market penetration, and contributes to long-term brand loyalty. Disregarding the nuances of the target audience can lead to misaligned product features, ineffective marketing campaigns, and ultimately, diminished sales potential. The impact of target audience understanding can directly improve profitability in the business.

5. Collectibility factor

The collectibility factor significantly influences the market dynamics surrounding licensed character accessories, particularly in relation to a “goofy loungefly backpack.” This aspect extends beyond mere consumer demand, encompassing elements of rarity, nostalgia, and investment potential. Its presence shapes purchasing decisions and contributes to a secondary market for these items.

- Limited Editions and Exclusivity

The production of limited edition or exclusive designs directly impacts the collectibility of a “goofy loungefly backpack.” Scarcity drives demand, prompting consumers to acquire these items as investments or for their perceived uniqueness. For example, a backpack produced for a specific convention or retailer, with limited quantities available, often commands a premium on the secondary market. The perception of exclusivity elevates the item’s desirability among collectors.

- Character Popularity and Nostalgia

The enduring popularity of Goofy and the associated nostalgia contribute to the collectibility of these backpacks. Consumers often seek items that evoke fond memories or represent beloved characters from their childhood. A “goofy loungefly backpack” taps into this emotional connection, creating a sense of personal value and investment beyond mere utility. This emotional resonance fuels demand and increases the likelihood of the item becoming a sought-after collectible.

- Brand Reputation and Quality

Loungefly’s established reputation for producing high-quality, officially licensed merchandise enhances the collectibility of its products. Consumers trust the brand’s adherence to licensing agreements and its commitment to design and construction standards. This trust translates into a willingness to invest in “goofy loungefly backpack” items, believing that they will retain their value and appeal over time. Counterfeit or unlicensed alternatives lack this inherent trust factor, diminishing their collectibility.

- Secondary Market Value and Resale Potential

The existence of a robust secondary market for these backpacks underscores their collectibility. Active trading and resale platforms provide a mechanism for valuing and exchanging these items, further reinforcing their investment potential. A “goofy loungefly backpack” that commands a strong resale value becomes more desirable to collectors, who view it as an asset rather than simply a functional accessory. Monitoring secondary market trends provides valuable insights into the factors driving collectibility and demand.

In summary, the collectibility factor associated with a “goofy loungefly backpack” is a multifaceted phenomenon driven by scarcity, nostalgia, brand reputation, and secondary market dynamics. These elements converge to create a perceived value that extends beyond the item’s functional purpose, transforming it into a sought-after collectible for enthusiasts and investors alike. The interplay of these factors contributes significantly to the overall market success and cultural significance of these character-themed accessories.

Frequently Asked Questions

The following addresses common inquiries regarding a Goofy Loungefly backpack, providing concise and factual information.

Question 1: What materials are typically used in the construction of a Goofy Loungefly backpack?

Goofy Loungefly backpacks often utilize faux leather (polyurethane), nylon lining, and metal hardware. The specific composition may vary between designs.

Question 2: How can the authenticity of a Goofy Loungefly backpack be verified?

Authenticity can be verified by examining the quality of materials, stitching, and hardware, as well as the presence of official Disney and Loungefly branding. Scrutinizing the licensing information on the product label and comparing the design to official product releases is also advised.

Question 3: What is the average size and carrying capacity of a Goofy Loungefly backpack?

The average dimensions are approximately 9″W x 10.5″H x 4.5″D. Carrying capacity is sufficient for everyday essentials, such as a wallet, phone, keys, and small personal items. It is not designed for heavy loads.

Question 4: How should a Goofy Loungefly backpack be properly cleaned and maintained?

Cleaning should be done with a damp cloth and mild soap. Avoid harsh chemicals or abrasive cleaners. Store in a cool, dry place away from direct sunlight to prevent fading or discoloration. Regular cleaning and proper storage are essential for maintaining the backpack’s condition.

Question 5: What is the typical price range for a Goofy Loungefly backpack?

The price range typically falls between $75 and $95 USD, depending on the design, rarity, and retailer. Prices may vary on the secondary market based on collectibility and demand.

Question 6: Are Goofy Loungefly backpacks suitable for children or adults?

These backpacks are generally suitable for both children and adults, although the size and weight may be more appropriate for older children and adults. The target demographic typically includes Disney enthusiasts and collectors of all ages.

This FAQ provides fundamental information to assist in understanding and appreciating this themed accessory.

The subsequent section will explore potential future trends in character-themed merchandise and Loungefly’s role within the industry.

Conclusion

The preceding analysis has provided a comprehensive overview of the “goofy loungefly backpack,” encompassing aspects ranging from design considerations and material quality to target audience demographics and collectibility factors. The exploration underscores the multifaceted nature of this character-themed accessory and its position within the broader landscape of licensed merchandise.

As the market for themed accessories continues to evolve, manufacturers must remain attuned to shifting consumer preferences and embrace innovative design approaches. A sustained focus on authenticity, durability, and cultural relevance will be paramount to maintaining market share and cultivating lasting brand loyalty. The future success of products such as the “goofy loungefly backpack” hinges on a nuanced understanding of consumer desires and a commitment to delivering exceptional quality and design.